99rises Performance: Return of Capital Wins

99rises has been created just for you

Purpose-based long-short investing

99rises performance

Bear markets are brutal. We are in one right now and one of the best ways to survive is to allocate capital to two-sided long-short strategies employed by hedge funds.

You say, "how can I get access to such strategies given the black-boxes that hedge-funds are?"

99rises has been created just for you

You don't need to be clairvoyant to predict bear market bottoms, but you need to take a few steps to minimize your bear-market losses while improving your long-term gains. You could even generate positive absolute returns via 99rises long-short strategies in bear markets.

And all this while investing in your goals, values and interests.

Purpose-based long-short investing

It is our mission to generate two-sided market uncorrelated alpha (or positive returns) irrespective if whether we are in bull or bear markets. And we want people to invest in their purpose.

We believe purpose has to be the center of your investing philosophy.

Purpose-based investing without a process or risk management can defeat the very meaning of achieving your goals. We have purpose-based investment blocks with sophisticated long-short risk management to help you find your 'North Star'.

99rises performance

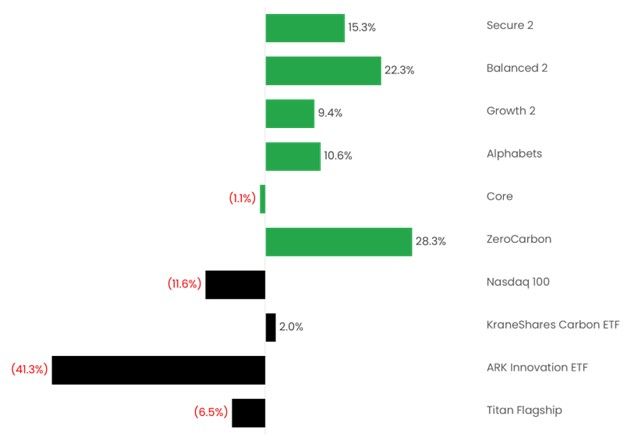

Our performance at the end of October 2022 speaks for itself when the Nasdaq 100 is down -30.9% and the S&P500 is down 19.3%.

Our three main long-short blocks are outperforming the S&P500 by +9.4% to +22.3%.

Our three main long-short blocks are outperforming the Nasdaq 100 by +21.0% to +33.9%.

All this, while inflation is up 8%+ and purchasing power has eroded by over 40% year over year, yes 40%. Our mantra is to preserve and protect capital so that clients can maximize returns. Bear markets are about return of capital and our blocks are outperforming, and actually giving our clients a return on their capital.

Share This